Invest in Ideas That Matter

We can now accept donations of securities—including shares, bonds and mutual funds—to support a journal of ideas about Canadian culture and public affairs.

At year-end, you’ll receive a tax-deductible receipt for their fair market value at the time of your gift. And when donating securities, you do not have to pay capital gains tax on any appreciation in value since they were purchased. So you can help support the work of the Literary Review of Canada, without incurring taxes you would otherwise have to pay on sale of the securities

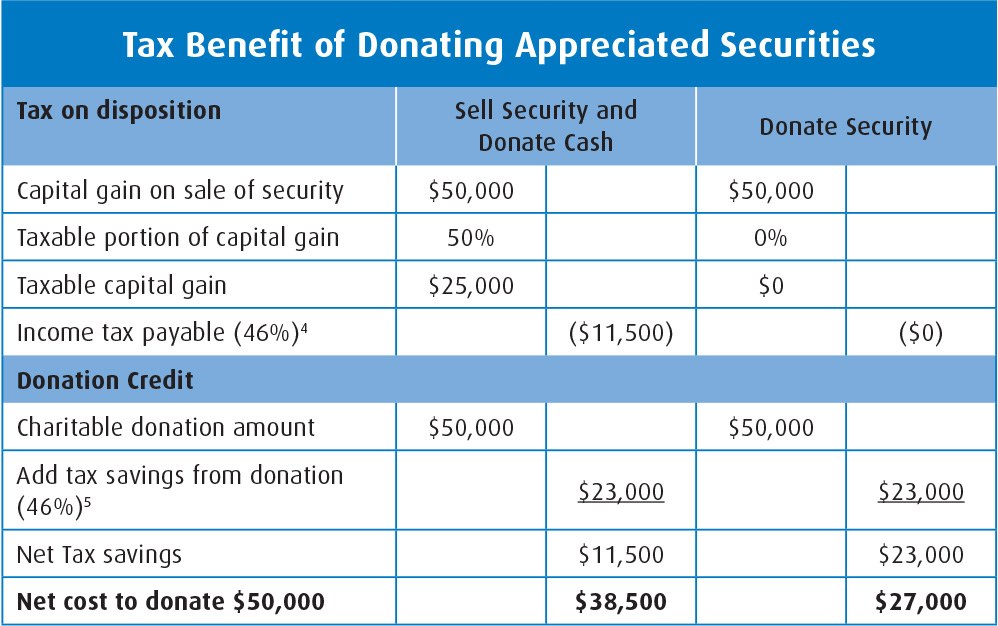

This helps you reduce the personal cost of your donation. The table below, for instance, compares the impact of a charitable donation when the gift is a qualified appreciated security (case on right), instead of the cash proceeds from the sale of that same security (case on left).

The example assumes an individual owns a security with a current market value of $50,000. For simplicity’s sake, this is taken to have a purchase price of zero, resulting in a capital gain of the full $50,000 on sale, with all income taxed at 46%.

(NB: This chart is for illustrative purposes only, and does not constitute specific tax advice. For more information on how a donation of securities might impact your personal finances, please consult other resources and/or a tax professional.)

To contact us about giving securities, please email info@reviewcanada.ca.