Ever since the Romans established a central currency system in the third century BC, money has been controlled by the state as a tool of political power. This control was exerted by manufacturing coins, issuing currencies backed by stored gold and, eventually, through central currency reserves. In each of these phases of monetary history, the state had near universal control over money. As such, the state could tax and regulate its use and fund its own activities.

Bitcoin was imagined by an anonymous computer programmer (or group of programmers—their identity is unknown) known as Satoshi Nakamoto in an attempt to break the tie between the state and money. It was intended to be the lingua franca of the internet—a currency born of, designed for and using the attributes of the World Wide Web.

Beyond being a technological leap from earlier digital currency experiments, bitcoin was also a more defined political project. Early bitcoin enthusiasts and developers saw it as an expression of digital libertarianism, and a means of pushing back against the state control of currency. Satoshi Nakamoto designed a system that allowed trust over financial transactions to be guaranteed and tracked by a distributed network of computers solving complex math problems, instead of entrusting governments, central bankers and financial institutions to control currency. Unlike other fiat currencies such as Facebook credits in the United States or Linden dollars in Second Life (an early virtual community), bitcoin exists free from the constraints of the structures and interests of any one institution.

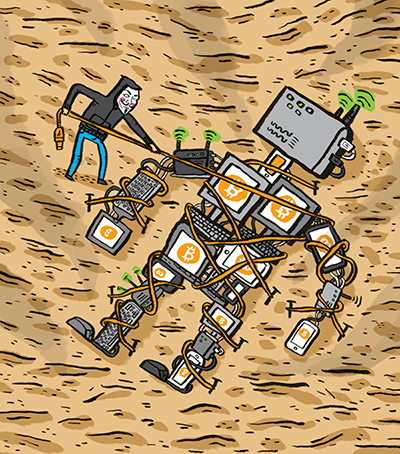

Ian Turner

Bitcoin itself is only one form of cryptocurrency and it has spawned numerous competitors. But its core innovation of a decentralized ledger of encrypted information has found a broader utility in what has become known as blockchain. Instead of just trading currency, blockchain promises to be a secure form of accounting for information more broadly. Put simply, before blockchain, if person A wanted to make a secure and verifiable exchange (of money, goods, services, title or information) with person B, they needed to go through a central trusted intermediary (a bank, exchange, regulatory agency, government). Trust was provided by these institutions, which in turn gained resources, control and power. The promise of blockchain is to cut out these intermediaries, and, in so doing, disrupt the world’s dominant power structures.

This could, in theory, address some major flaws in the current digital architecture. Despite the promise of the internet to flatten hierarchy and empower networks, which it has done in important ways, we have also seen the emergence of new centralized powers online. A lack of digital security has left the door open to mass surveillance, by both autocrats and democrats alike. The once level playing field of the World Wide Web is now largely controlled by a small number of large corporations. What we see and do online is being shaped by ever more complex algorithms, with little oversight or transparency. The internet of things will soon connect billions more devices, bringing a global information network into our homes and mass data collection on aspects of our lives. And, of course, the financial system remains beholden to big banks and currency under the control of states.

As the world becomes increasingly digital, a system of decentralized, secure and private authentication for content, objects or ideas could be immensely valuable.

Enter the Tapscotts.

Don Tapscott has emerged as one of the management consultant world’s most prolific evangelists for the business implications of digital technologies. He began this work studying his children’s generation, what he called digital natives, in a prominent book Growing Up Digital: The Rise of the Net Generation. While this term has since been widely debated (see danah boyd’s It’s Complicated: The Social Lives of Networked Teens), there is no question that in the world of TED Talks, Davos and corporate retreats, Don Tapscott is a key interpreter of the digital world for legacy institutions struggling to keep up. His son, Alex Tapscott, is an investment banker who teamed up with his father to write about what they argue is the next big leap in the digital ecosystem.

The result is Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business and the World. The book is at its best when explaining the complex concepts underpinning blockchain, but ultimately falls victim to an irreconcilable conflict at the heart of the blockchain movement—the growing divide in the cryptocurrency community between those who want to normalize its use and those who remain steadfast in its revolutionary potential. Put more starkly, while some view blockchain as a more efficient tool for financial services, market exchanges, online purchases and information sharing that can be adopted by established actors, others see it as a fundamental challenge to the hierarchical nature of power itself. These two visions of blockchain cannot coexist.

Blockchain, in Three Acts

Blockchain Revolution does three things.

First, it serves a thoughtful and well-constructed guide to what blockchain is and how it works. This is no easy task as the technology and concepts underpinning blockchain, and its antecedent bitcoin, are complicated.

At its core, a blockchain is a distributed trust network. As the Tapscotts call it, “a global ledger of truthful information.” Rather than requiring a centralized authority to determine the integrity of a transaction (a bank, a government, a regulatory body), a blockchain allows for this determination of integrity to occur via a decentralized network of computers holding and authenticating the ledger of content. The ledger is simply all of the information in the blockchain that has been validated. This could be the records of bitcoin exchanges, stock trades, land titles, taxes paid by citizens or the expenditures of a government. What is important is that all the information in the ledger exists on all nodes in the network, is accessible to all and has gone through a process of authentication.

This authentication of the information in the ledger is done through a distributed transaction verification process. New transactions are distributed to the network as blocks, and computers on the network compete to approve that the transaction is valid by solving complex math problems (such as a proof-of-work algorithm or consensus verification). Once a transaction is verified, it is added to the blockchain, and the ledger of information is updated and redistributed to the network. This has been compared to solving the missing pieces of a puzzle. And the act of problem solving is what ensures the security of the transaction.

In order to get around the collective action problem of decentralized networks (how to get individuals to participate for the betterment of the group), the blockchain system adds an incentive to participate in solving the math problems. When a computer in the network succeeds at being the first to solve a problem, it is rewarded (for example, with a small amount of bitcoin) and the new global ledger that includes the newly authenticated transactions are then distributed to the entire network. When a new block is added, the competition begins again. For cryptocurrencies, this process is called mining, because currency is produced as a reward for the computation power needed to solve the math problems that are essential to make the system function.

Together, the decentralized ledger, authentication process and incentive structure of blockchain form the core attributes of what makes the technology potentially so powerful. And this is where the book is at its best—free of the hyperbole that detracts from other sections of the book, and explaining complex concepts in an approachable way.

Second, Blockchain Revolution does a very good job of laying out the potential implications and uses of blockchain. As the authors state, “this book is about something bigger than the asset [of bitcoin]. It’s about the power and the potential of the underlying technological platform.” They lay out a wide range of potential uses, which I would group as either incremental or revolutionary.

On the incremental end is a range of capabilities and services that will make existing transactions more secure or more efficient. For example, the combination of securing contracts on blockchain and using bitcoin as currency would allow for vast networks of things to be connected. This could include cars and cargo, documents, devices in our home, energy grids, micro-computers such as “smart pills” and even, the authors suggest, farm animals: “cows can become blockchain appliances.” Although the implications of this universal list of everything are significant, and some might say dystopian, the benefits are clearly incremental—greater speed, efficiency, security, resiliency, privacy, productivity. Similarly, in the financial services sector, the authors rightly point to the layers of legacy technologies, systems and institutions, which make the market inefficient and suggest that blockchain could enable faster financial transactions, new forms of initial public offerings and faster trading. In the space of cultural production, blockchain could allow artists to distribute and sell their work independently and could help protect intellectual property. Blockchain technologies and services could help government deliver services, help secure infrastructure and facilitate online voting.

But there is another set of capabilities outlined by the Tapscotts that are fundamentally revolutionary. Blockchain, for example, could allow for the free and secure global flow of capital. The example often used is of remittances, but clearly the implications are more far reaching. Blockchain could also enable greater free and secure speech, out of the prying eyes of corporations and governments. If corporations would use blockchain as their general accounting ledger, it would create complete financial transparency. And blockchain could facilitate new experiments in decentralized democratic participation. If governments moved more of their activities to blockchain, the authors argue, “everything on government networks could be verified without having to trust humans … it’s impossible for the government to lie to its citizens.” They go even further, arguing that the blockchain ledger could possibly even function as a form of self-regulation. These are markedly apolitical statements and signal a central challenge of this book that I will turn to below.

Third, this is a business book. Virtually every chapter is positioned as a pitch to how blockchain could disrupt a sector of the economy, and the overall goal of the project is to provide a “roadmap to prosperity.” The authors point to the opportunity of the sector: in 2014/15, $1 billion of venture capital funds were invested in the blockchain ecosystem, and this is doubling annually. They outline how blockchain could upend the 20th-century firm, and they detail a wide range of new potential business models enabled by the underlying technology. Even the chapter on culture is really about the business of cultural production.

There is nothing inherently problematic about this—the book is aimed at a corporate audience—but it does lead to the core challenge of their argument. In my view, blockchain is either an innovation that will be incorporated by established institutions and innovators as we transition to the digital world or it is a revolutionary technology that radically upsets traditional power structures. I do not see how it can be both. And if it is the latter, then no amount of cheerleading will slow legacy institutions, whether they be nation-states or multinational organizations, from fighting blockchain with all their remaining power.

The Paradox of Blockchain

There are two competing and ultimately irreconcilable futures for blockchain.

First, following in the vision of bitcoin founder Satoshi Nakamoto is the proposition that blockchain is a radically flattening technology that will undermine both traditional legacy institutions and current platform companies as intermediaries of trust. Proponents of this view are often called crypto-anarchists, a term with which I doubt the Tapscotts identify.

New cryptocurrencies are already being used by groups seeking to undermine state power. The Oglala Lakota Nation in Idaho recently launched its own electronic currency called MazaCoin as a means of increasing its independence from the U.S. government. The nation views currency control, in this case, mining its own cryptocurrecy, as an act of sovereignty. And new, more radical technologies such as Dark Wallet are emerging, which offer a higher degree of anonymity that more mainstream bitcoin tools. Created by an anarchist group, one member of which is Cody Wilson, who became infamous by 3D printing a gun, Dark Wallet is an attempt to return bitcoin to its radical and revolutionary roots. As a website promoting the technology states “Bitcoin is the next battleground in the fight against supranational political domination … Digital anonymity and freedom of financial speech are some of the last tools left in the dwindling garrisons of Liberty.” This is the rhetoric of revolution, not incremental innovation.

But there is also a competing vision for the future of bitcoin and the blockchain, one backed by prominent Silicon Valley venture capital firms and global investors. This competing model sees these technologies normalized into the current economic system. Investors such as Marc Andreessen see bitcoin as the future currency of the internet. They want bitcoin to be the next PayPal, with all of the IPO potential that will follow. It would simply be a cheaper and more efficient way of spending money. Similarly, central banks are exploring the use of cryptocurrencies as alternate forms of national monetary exchange. Hardly an anarchist’s dream.

The challenge facing both the future of blockchain as well as the premise of this book is that these two visions are fundamentally incompatible. For every one company that wants to be the bitcoin exchange for online retailers, any number of others could seek to be the next Silk Road—one of the inaugural online black markets, made infamous for trafficking drugs—or revolutionary currency. And they would both rely on the exact same technology.

Take, for example, the oft-cited case of remittances, where billions of dollars in annual transactions between foreign workers and their families often go through seven intermediaries, are charged as much as 30 percent in fees and can take over a week. A bitcoin exchange could allow these funds to be transferred in minutes and for pennies directly to mobile phones. Surely this is a positive disruption?

The problem is that the same technology that allows for this free and open transfer of money also allows for black market money exchange across borders. If bitcoin is designed to protect owners from the potential risk of government-controlled currency, it also is structured to exist out of the reach of the state. Because there is neither a central authority nor intermediaries between participants in a financial transaction (i.e., banks), there is no point of interaction that government can regulate. This means transactions cannot be taxed or even monitored for criminal activity. It also means that the international legal system overseeing financial transactions is rendered futile. The reason remittances go through so many intermediaries, after all, is to ensure that funds are transferred securely and legally and that they are not used for illicit purposes. This oversight is applied by the multiple jurisdictions potentially affected by or responsible for the transactions. But jurisdictions do not make sense in a decentralized and pseudo-anonymous system. Even more problematic, the distributed nature of the network means that finding and shutting down any one node will have no effect on the wider system.

The consequence of this is that if the use of bitcoin were truly to proliferate, then the inability of the state or financial institutions to collect revenue from and regulate commercial activity will quickly become a threat to the control they currently hold over the financial system. The global flow of capital would become a new ungoverned space. Do we really think governments are going to allow this to emerge?

Or take, for example, the 2.5 billion people in the world who are unbanked and therefore largely cut off from markets because they do not have conventional bank accounts. The Tapscotts argue that blockchain could be a leapfrog solution “by lowering barriers to financial inclusion and enabling new models of entrepreneurship.” But why do we think banks and financial institutions, arguably the most powerful global actors, are going to allow for a decentralized competitor to completely undercut their market? And if they truly thought that blockchain held this potential, would they be experimenting themselves with the technology, or instead doing everything in their power to fight it?

The problem ultimately facing governments, then, is that the very characteristics that make bitcoin powerful, such as its anonymity and decentralized network, mean that it is very difficult to control how it is used. The same technology that facilitates illicit uses will also underlie legal exchanges. And faced with the choice of enabling the beneficial uses of bitcoin at the cost of proliferating the illicit uses, governments are unlikely to support its normalization into the financial system.

Put another way, the very attributes of cryptocurrencies that would allow Zimbabweans to protect their money from hyperinflation, Cypriots to prevent government seizure of their bank accounts, migrant workers to send money back to their families for free or your fridge to pay its own bills also make it impossible for governments to collect taxes, regulate international financial transactions and monitor organized crime.

And herein lies the challenge for the Tapscotts’ vision of blockchain as a tool of prosperity and freedom. The government could, and indeed must, try to impede what it perceives as negative behaviour or even existential threats using blockchain, but doing so will radically curtail the legitimate normalized use of the very same technology. I am excited by the ideology of decentralized power embedded in the vision of blockchain, but as with many techno-utopian visions it is too often projected as apolitical. Blockchain could be the radical challenge to power that some of its proponents envision, but if so, then the political and economic actors from whom this power will be taken will surely fight any widespread adoption of the technology.

And so this book could have been either an anarchists’ manifesto or a business handbook. But it does not work as both. And in trying to match the revolutionary rhetoric of the potential of blockchain with the desire to normalized its use in the global economy, Don Tapscott and Alex Tapscott have missed the central challenge facing both blockchain advocates and the institutions they are taking on.

Taylor Owen is a professor of digital media and global affairs at the University of British Columbia, a senior fellow at the Columbia Journalism School and author of Disruptive Power: The Crisis of the State in the Digital Age.